Mind your business: Safeguarding your business against loss of mental capacity

Mental capacity

Entrepreneurs typically devote significant time and money building a successful business and their interests in the business (such as shares in a limited company or an interest in a partnership) often represents a large proportion of their personal wealth.

However, while many entrepreneurs take steps to determine the succession of their business interests on their death, they often fail to safeguard against the risks of losing mental capacity during their lifetime. This can be especially impactful for owner-managed businesses with a small number of shareholders, some or all of whom are also directors.

Risks for entrepreneurs

Mental capacity is an individual’s ability to take decisions for themselves. In practical terms, a person has capacity if they can understand and retain information relevant to a decision, analyse that information as part of the decision-making process and communicate their decision. The law recognises that mental capacity is a grey area; it is both time-specific (eg an individual might have capacity in the morning but not in the evening) and decision-specific (eg an individual might have capacity to buy a pint of milk but not to sell shares in a company).

As many will be aware, the risks of losing mental capacity can be severe; the individual will be unable to take any decisions for themselves and, in the absence of a Lasting Power of Attorney (LPA), a costly and time-consuming application will need to be made to the Court of Protection to appoint a deputy to make decisions on their behalf.

These risks are particularly pronounced for entrepreneurs, as they will be unable to fulfil their role as a director/partner or exercise their rights as a shareholder. This can create significant disruption in the day to day running of the business and may lead to a standstill while the directors/partners and/or shareholders take steps to remove or replace the incapacitated individual. These issues are most acutely felt for small businesses, particularly those with a sole shareholder and director, where there may be no option but to apply to the Court of Protection to appoint a deputy to act on their behalf (and pending such appointment, the business may be unable to conduct its operations, impacting current trade and future value).

Protecting your business

Individuals can safeguard against loss of mental capacity by preparing and registering LPAs, which are legal documents that allow an individual (the donor) to name a person or persons (the attorney(s)) to take decisions on their behalf in the event that they become incapable of making such decisions themselves.

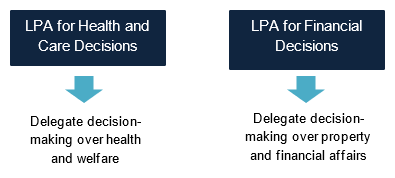

There are two types: an LPA for Health and Care Decisions, under which the donor can delegate decision making regarding their health and welfare, and an LPA for Financial Decisions, under which the donor can delegate decision making regarding their property and financial affairs.

The issue for entrepreneurs is that the individuals they appoint to take decisions regarding their property and financial affairs (typically their spouse and/or adult children), may not have sufficient knowledge and/or experience to take decisions regarding their business. Indeed, there may not be another suitable person to take on such a role who has not already been inside the business for some time.

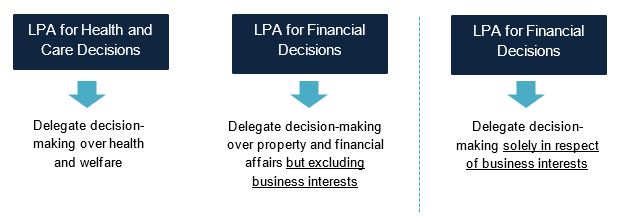

In this situation, entrepreneurs should consider preparing a Business LPA. In summary, a Business LPA is an LPA for Financial Decisions, which applies solely to the donor’s business interests. The entrepreneur would typically have:

- an LPA for Financial Decisions relating to their personal property and financial affairs (a Personal LPA); and

- a Business LPA relating solely to their business interests.

There is no limit on the number of LPAs that a donor may have and so if the donor has numerous business interests, they can decide whether to register one Business LPA dealing with all their business interests or a separate Business LPA for each business (for example, one Business LPA dealing with shares in ABC Limited, a separate Business LPA dealing with their shares in XYZ Limited and so on). In either case, it is imperative that the terms of the LPAs align with one another and there is no overlap in scope, which could create difficulties for the attorneys when making decisions at a later date.

The attorneys’ authority will not extend to the donor’s duties as a director, as this is a personal appointment and can only be discharged by the person holding that office. In practice, the attorneys would act to exercise the voting rights held by the donor as shareholder to remove the incapacitated director and appoint one or more replacements to act in their place. Those newly appointed directors can then take decisions for the business.

While a Business LPA is an important mechanism to protect against loss of capacity, it can also be used before the donor has lost capacity with their authority, which offers practical benefits, for example if the donor is travelling or physically incapacitated.

Constitutional documents

The terms of the Business LPA should be aligned with all the business’ constitutional documents (including the company’s articles of association, shareholders’ agreement and/or partnership agreement) to ensure that any provisions regarding the incapacity of directors or partners do not conflict with one another and they contain sufficient flexibility to enable the business to continue to function if a director, shareholder or partner loses mental capacity. If not, decision making can be stymied and ever simple decisions can be hugely delayed.

In particular, the business’ governing documents should be reviewed to check the following:

- the appropriateness of the existing quorum requirements for board, shareholder or partners’ meetings;

- minimum director / partner thresholds;

- director / partner termination formalities;

- voting thresholds for key decisions (at board and shareholder level); and

- provisions governing the appointment of alternate directors, delegation of powers and establishment of committees (which may be able to carry on certain business).

A businesses’ governing documents can be tailored to specifically dovetail with the Business LPA, so that any future third party shareholders are automatically bound to co-operate with the process.

As set out above, it should be emphasised that even where a Business LPA is put in place and the articles of association align with its terms, directors are unable to delegate their responsibility to act as a director as it is a personal appointment.

Practical considerations

Before registering a Business LPA, it is important to consider the following:

- Choice of attorney(s): the donor should ensure that they appoint attorneys that have sufficient knowledge and/or experience to take decisions regarding the business. Crucially, the donor should not appoint attorneys if this will give rise to a conflict of interest (for example, if the attorneys also hold shares in the business where their interests may not be aligned). If the attorneys are professionals, the donor should consider whether they should be able to charge for their services.

- Wishes: the donor should prepare a private letter of wishes to their attorneys setting out their views for the future of the business and providing some guidance on how it should be run (this could include an expression of intent for succession, how to approach possible exit scenarios and even more specific operational matters).

- Position of other stakeholders: for businesses with small numbers of partners/shareholders, etc., their operations could be impacted if any one of them is unable to act. It is important to consider whether these other stakeholders should also put Business LPA arrangements in place to prevent a situation where they cannot act (particularly if the governing documents require unanimous consent for the business to take certain steps).

- Scope: as set out above, it is important to ensure that there is no overlap in scope between the donor’s Personal LPA and Business LPA, as this may create conflicts for the attorneys at a later date (for example, if the attorneys of the Personal LPA can also take decisions regarding the donor’s business interests and vice versa).

- Death: the donor should also ensure that they have prepared a suitable Will dealing with the succession of their business interests on their death. The company’s articles of association should also be consulted to ensure that they permit the provisions set out in the Will.

For more information, please contact Julia Cox and Thomas Denny in our UK Private Client team or Hamish Perry and Mike Barrington in our Corporate team.