The New UK Net Zero Carbon Buildings Standard 2024 – an ESG milestone?

Introduction

Until now, nobody has been able to agree on a single definition of what a “net zero carbon building” is – despite so many industry players aiming to reach it. In a milestone development, September saw the launch of the new, landmark pilot UK Net Zero Carbon Buildings Standard (the Standard) from an unprecedented collaboration of industry bodies, developers and local authorities, and contractor and consultant firms.

With input from thousands of people and projects, this demonstrates a genuine joint effort to encourage the UK built environment industry to embed a net zero carbon ethos. The Standard creates the single definition the industry needed, and sets out specific, measurable requirements for buildings to reach it. Project teams will have to voluntarily choose to adhere to the Standard, though this will have various benefits.

The pilot standard

The Standard was dreamed up in early 2022 – and accepted submissions from potential users of the Standard over the following two years. The result is a science- and industry-backed document that covers building uses from commercial, residential, retail and office space to culture, leisure, healthcare, education and storage. It includes a set of goal outcomes that were developed both top down (considering what would be required to keep construction carbon usage to under set limits) but also bottom up (using the data provided by future users to allocate those targets by building use and operation type).

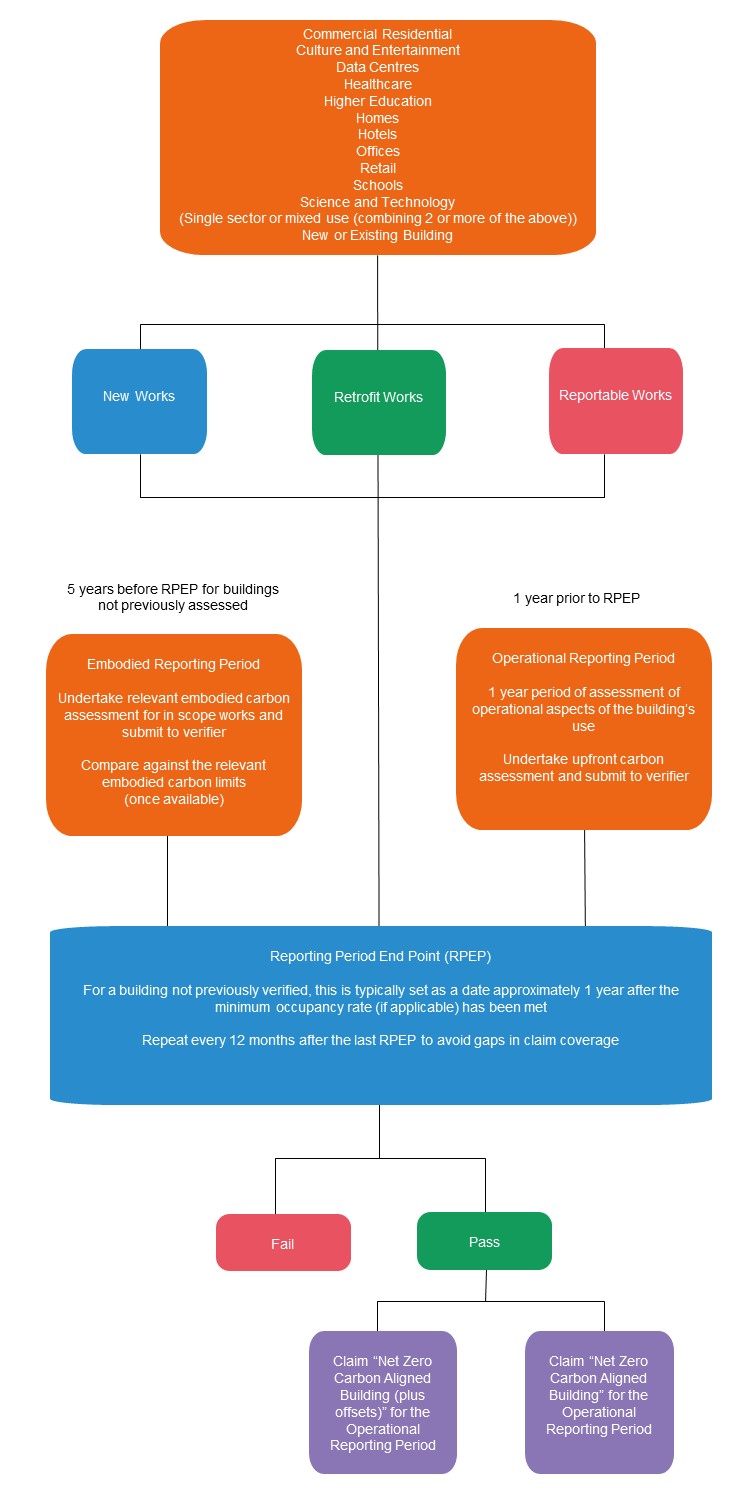

The Standard specifies how embodied and operational carbon emissions (including energy use) should be measured and sets clear limits for the same according to building type, purpose and year. The now-published pilot helps us to understand how the Standard will function:

- Projects will need to hold sufficient data on both embodied carbon and energy usage while operational and occupied;

- Buildings can claim conformity for a 12-month period in retrospect, once an independent verifier has certified data on operational energy usage during that timeframe;

- Operators can use the terms “Net Zero Carbon Aligned Building”, or “Net Zero Carbon Aligned Building (with offsets)” – carbon offsetting cannot replace compliance with the mandatory targets, but is encouraged; and

- Where a building later falls below the requisite targets, it can no longer use the net zero claim - except to say that it has been compliant during specific years.

The Standard also includes an expectation that buildings will improve over time. The numerical limits for compliance decrease over time, making the Standard harder to achieve with every passing year. Most of the reduction expected by the Standard come from embodied carbon: while it envisages incremental reductions for operational energy use, around 90% of the reductions come from the embedded element. This reflects the greater potential savings in embodied carbon as a relatively newer consideration, as opposed to the more mature approach already taken to energy usage and efficiency during occupation.

As the Standard is a pilot version at this stage, interested parties are expecting a period of industry stress testing and review will follow, with feedback expected to be incorporated into a final version for publication in 2025 or beyond.

Some data is still outstanding. We’d expect this to be rectified by the final version, including limits on life cycle embodied carbon (total greenhouse gas emissions and removals, both operational and embodied, over the building life up to and including disposal) for new works, and upfront carbon limits – i.e., carbon from construction products and processes – for reportable works (including new projects, retrofit works and other works under £100,000 in value or replacement lighting systems or heating/cooling/ventilation). Test projects are being sought for both new projects and retrofit schemes, which will likely play a big role in setting those limits.

What’s it all for?

At the heart of the construction industry are two themes: people and place. Climate change threatens both of those. To mitigate its impacts, global temperature rise should be limited to an average 1.5 degrees Celsius in line with the Paris Agreement – and that requires work. In short, it’s a collaboration for the greater good, and the Standard aims to keep the UK’s built environment to its share of those carbon/energy budgets.

As for adoption of the Standard, there are commercial drivers as well as moral ones, including:

- Regulatory Compliance: Around the world, governments are legislating on carbon emissions and sustainability matters. Energy efficiency, material sourcing and use, and general sustainability are all likely to be a focus in coming years – adhering to the standard will not only ensure compliance now, but assist in future-proofing, and reducing the risks of developments becoming non-compliant.

- Corporate Responsibility: environmental, social, and governance (ESG) criteria are ever more important to investors, shareholders, and customers. Corporations can improve their reputation as well as their impact by demonstrating a measurable sustainable change. Entities are increasingly setting net zero targets (from investment funds to commercial landlords and tenants), fuelling demand for energy efficient, sustainable buildings from all directions.

- Financial Incentives: There are direct monetary benefits to developing green buildings, including in the form of tax benefits, improved investment choices, reduced interest loans, or grants, as well as reduced operating costs for more efficient built assets, which can improve project viability. Consumer awareness can also mean that green projects attract higher rent or sale values, longer leases and higher occupancy rates, and may retain value better in the coming years – current figures from Jones Lang LaSalle show green premiums in the London market of 11.6%.

Thinking about adopting it?

Key players are hopeful that this Standard will encourage a focus on net zero carbon projects from parties who may not otherwise pursue sustainability in the same way.

Users of the Standard will benefit from early adoption – utilising its metrics right from project inception; creating and maintaining quality records will be key for later verification of any net zero claims. Adherence to the Standard will need much more than a good initial design: there will be new considerations at every stage including material sourcing, waste, and ongoing use.

As always, good contracting practices can help all parties be sure on their respective obligations. For clients procuring works, adopting contractual mechanisms such as KPIs may support the upfront embodied carbon goals but at the heart of this will be a need for collaboration across the project team and the supply chain.

Green leases will be a fundamental tool for landlords, enabling them to work with their tenants to bring their operational energy within the prescribed limits. Requirements for data sharing, incentives for sustainable practices, and obligations relating to energy use, water and waste will all contribute to meeting the targets set out by the Standard.

One key question for the Standard in practice is the 12-month look-back reporting period. With certification only available for buildings after a year of occupation and use, it’s not going to be a useful marketing attraction for sale or rent of new builds – except in terms of a building that “aims to be compliant” or is projected to be. What agents, tenants and developers make of this in time remains to be seen.

Public adoption of the Standard from across the industry will be needed to move it from a novel idea to a mainstream consideration. Ultimately, that might be what the industry needs.